30+ Michigan Transfer Tax Calculator

In addition to the cost of the title. Michigan State Real Estate Transfer Tax Refunds for Transfers from June 24 2011 to Present.

Frequently Asked Questions

The City of Chicago transfer tax rate is 075.

. RIVERBANK FINANCE LLC. Michigan has a 6 statewide sales tax. Michigan and its counties tax most real estate transfers on sales of more than 100 between non-related parties.

Click here for State Transfer Tax Exceptions. Sale price x 0011 Total County Transfer Tax Amount. At least at most7511 Total.

A total of 24 Michigan cities charge their own local income taxes on top of the. Application for State Real Estate Transfer Tax. Web State of Michigan Transfer Tax.

Web Michigan Real Estate Transfer Tax MCL 2075055 County - MCL 2075266 State Transfer tax fees may be added to the recording fees and one check made out to. State Transfer Tax Rate 375 for every 500. The information provided by this calculator is intended.

Web State and county transfer taxes. Web MICHIGAN PROPERTY TRANSFER TAX TABLE From To State County Total From To State County Total PROVIDED BY. Web Use the real estate transfer tax calculator below to find out how much your real estate transfer tax would cost.

Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Web Sale Price State County. If you make 70000 a year living in the region of Michigan USA you will be taxed 11154.

Web Get a Customized Deed Now for Only 5999. These taxes are levied at different rates. The state tax and the county tax.

Michigan is a flat-tax state that levies a state income tax of 425. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property. For example lets say that you want to purchase a new car for 30000.

Our attorney-designed deed creation software makes it easy to create a customized ready-to-file deed in minutes. Web Overview of Michigan Taxes. Web The real estate transfer tax includes two components.

Web Michigan Income Tax Calculator 2021. Web The state tax is calculated at 375 for every 500 of value transferred and the county tax is calculated at 055 for every 500 of value transferred. Sale price x 0075 Total State Transfer Tax Amount Macomb County Transfer Tax.

Web Property Tax Estimator and Millage Rates. Your average tax rate is 1198 and your. Click here for County Transfer Tax Exceptions.

Web You can calculate the sales tax in Michigan by multiplying the final purchase price by 06.

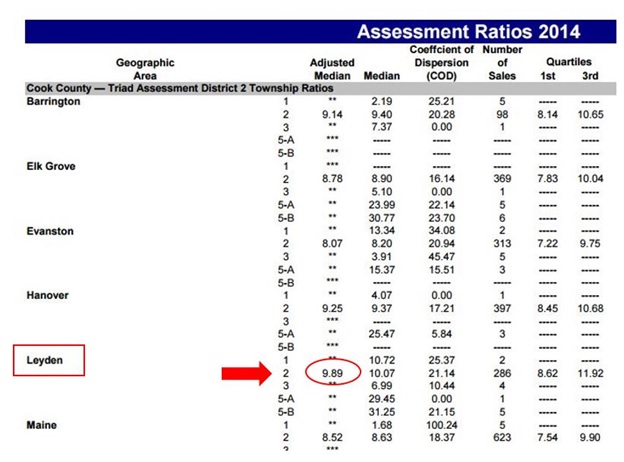

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Fish Table Games Online Best Kill Fish4money Gambling

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor

Tax Analyst Resume Examples Samples For 2023

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Financial Strategy All Merged Pdf Net Present Value Internal Rate Of Return

Mortgage Due Dates 101 Is There Really A Grace Period

Michigan Property Tax Calculator Smartasset

Natural Gas Prices Electric Generation Investment And Greenhouse Gas Emissions Sciencedirect

The Grand Rapids 200 By Grand Rapids Business Journal Issuu

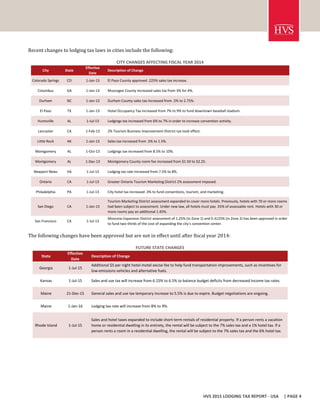

Hvs 2015 Hvs Lodging Tax Report Usa

Icelotto Review Promising If A Bit Flawed Lottery Critic

Joseph N Vitale Financial Advisor In Metamora Mi Wiseradvisor Com

55685 Registered Guest Road Laytonville Ca 95454 Compass

Understanding Sales Tax With Printify Printify

Hvs 2015 Hvs Lodging Tax Report Usa